The Rise of Jewellery: LVMH's $14.5bn Offer to Tiffany & Co

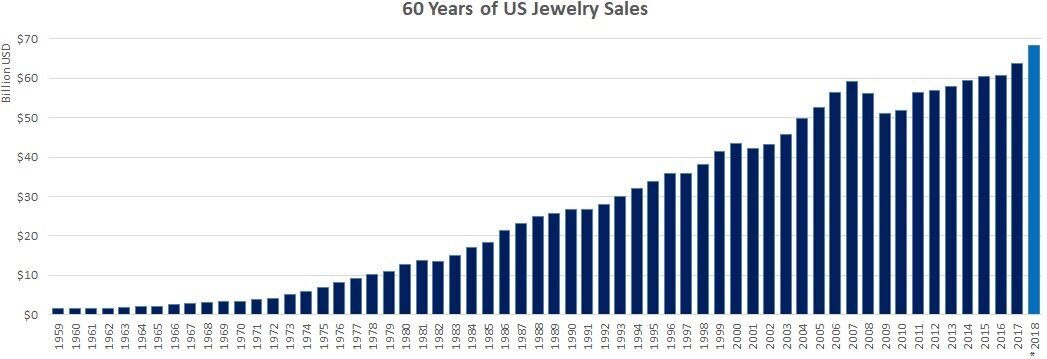

Although the global market for jewellery has been growing steadily for the past century (see graph below), it has seen a recent bump in demand as the world of fashion casts its gaze over it. The fashion industry is actively seeking to channel this growth within the realm of accessories, with supermodels like Gigi Hadid being the face of Messika and Bella Hadid as an ambassador for Bulgari.

Seeing this growing potential for investment, multinational French company LVMH - owning over 60 brands around the world - has offered Tiffany & Co $14.5bn with the aim of acquiring the company and expanding its portfolio further into the rising jewellery market.

On One Side of the Deal…

LMVH Moët Hennessy – Louis Vuitton SE, commonly known as LVMH, is a French multinational luxury company. It was formed in 1987, under the merger of fashion house Louis Vuitton with Moët Hennessy, a product of champagne producer Moët & Chandon and cognac manufacturer Hennessy conjoining.

LVMH directs around 60 subsidiaries, each overlooking smaller prestigious brands, yielding over $46bn in annual revenue. With 40.9% of company shares, Christian Dior SE holds the majority of voting rights, playing a pivotal role in the decision to acquire jewellery brand Tiffany & Co.

On the Other Side of the Deal…

Tiffany & Co, informally “Tiffany” or “Tiffany’s”, is an American luxury jewellery retailer with HQs in NYC. The brand markets itself as a determiner of “taste and style” (Via), often mentioned in popular culture, most famously in the 1960s classic Breakfast at Tiffany’s.

What’s in it for LVMH and for Tiffany?

When it comes to fashion, the global jewellery market is on the rise, topping a 7% growth in 2018 and valued at around $18bn. “Tiffany, with more than 300 stores globally, is one of the world’s largest jewellers, along with Cartier and LVMH-owned Bulgari, but it has been unable to keep pace with European rivals” (Via).

Despite recent efforts to diversify its target market, including the launch of new products and pop-up stores worldwide aimed at attracting same-sex couples, minorities and younger customers, Tiffany has seen a steady slip in both US and Asia sales.

As noted, LVMH already has some presence in the jewellery and watchmaking market, owning brands such as Bulgari and higher-end Harry Winston as well as Hublot and Tag Heuer. Acquiring Tiffany would represent another step in gaining market share in the growing subcategory of fashion.

The deal would result in increased US presence for LVMH and a strengthening of Tiffany’s product line, since “LVMH could use its deep pockets to develop product lines where Tiffany is weak.” (Via)

Looking to invest in some new accessories this holiday season? Make sure to keep an eye out for the upcoming jewellery launches, since consumers will be spoilt for choice once Tiffany’s competitors set in motion their own product proposals.